This often leads to a reactive posture. You discover your full financial picture in February of the following year, long after the window has closed to make strategic moves that could have saved you thousands. It can feel like you’re simply bracing for impact, with no ability to change the outcome.

But what if you could shift from being reactive to proactive? A recent Q&A session with business owner Richard Marvel and accountants Ryan and Karen from FirmTrack Solutions revealed a few powerful insights that can change this dynamic. As a financial strategist, I see this reactive scramble all the time, and their conversation perfectly highlighted three shifts in thinking that can break the cycle.

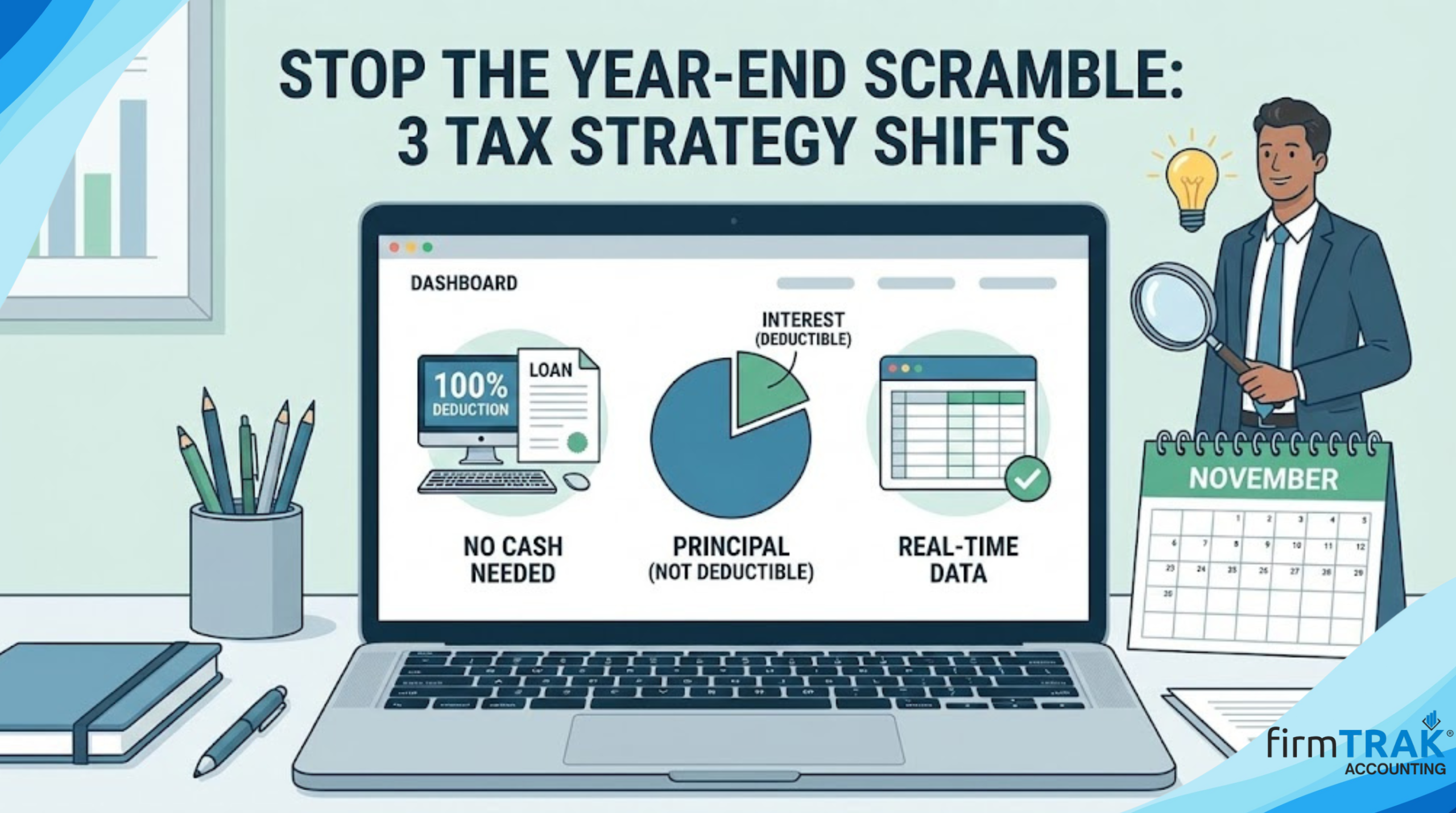

Thanks to tools like bonus depreciation, you can get a 100% deduction for certain assets in the year you acquire them. For example, if you need $25,000 worth of new computers to offset your income for 2025 but don’t have the cash, you can finance the purchase. Even though you haven’t paid for the computers outright, you can still take the full $25,000 deduction in 2025.

The core insight here is that the act of acquiring the asset (the purchase) and the act of paying for it (the financing) are two separate transactions in the eyes of tax law. Transaction one is the purchase: you add a $25,000 asset (computers) to your books. Transaction two is the financing: you add a corresponding $25,000 liability (the loan) to your books. The tax deduction is tied to the acquisition of the asset, not the cash leaving your bank.

You’re basically creating two separate transactions on your books and they they go from there based on the tax rules…

This naturally leads to the next question, which the business owner in the discussion immediately asked: what happens in the following years with the loan payments? Like many owners, his initial thought was that the entire payment must be a write-off. The accountants were quick to clarify this critical, and often misunderstood, distinction.

It’s critical to understand that your loan payment consists of two distinct parts:

• Principal: This is the portion of the payment that reduces your loan liability. Since you already received the full tax benefit upfront via bonus depreciation, paying down the principal is not a deductible expense.

• Interest: This is the cost of borrowing the money. The interest portion of your loan payment is a deductible expense that reduces your taxable income over the life of the loan.

If your loan has a 2.5% interest rate, only the small portion of your monthly payment covering that interest is deductible—the rest is simply paying down the principal you already got a deduction for. This is more than just a bookkeeping rule; it’s essential for cash flow forecasting. If you mistakenly think your entire loan payment is lowering your tax bill, you will be in for a nasty surprise.